Breaking: US Fed Hikes Interest Rate By 25 Bps; Bitcoin Price Dips

Also Read: Terra Luna Classic To Burn 800 Million Tokens, LUNC And USTC To $1?

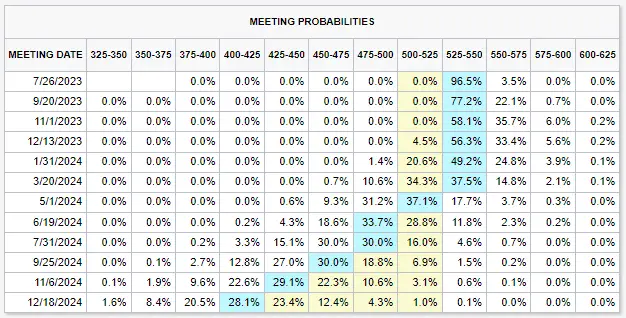

Outlook For Upcoming FOMC Meetings

In recent statements, the Fed officials have been warning of the possibility of two more rate hikes in the current year. This means there could likely be one more rate hike coming, after the rates already reaching the highest level since 2001. The FOMC reiterated that its target is to achieve maximum employment and limit inflation at the rate of 2 per cent over the longer run. Analysts predict that if the rate hike pause kicks in from the next FOMC meet, the January 2024 meeting could likely deliver the first rate cut.

“In support of these goals, the Committee decided to raise the target range for the federal funds rate to 5-1/4 to 5-1/2 percent. The Committee will continue to assess additional information and its implications for monetary policy.”

Recommended Articles

Bitcoin Price Maintains Sideways Action

Meanwhile, the Bitcoin Price (BTC) could potentially reach new highs in the current year as the Crypto Market is likely to become increasingly bullish over the Bitcoin halving around April 2024. In the lead up to the Fed meeting, the BTC price has barely fluctuated, remaining flat compared to 24 hours ago. It remains to be seen how the Crypto Market will react to this news as it was on a widely expected lines.

Fed Chair Jerome Powell is scheduled to deliver his comments on the FOMC’s position in a post meeting press conference.

Also Read: FOX Sr. Journalist Calls Ripple Case Ruling “Dual Notion”; XRP Lawyer Replies