On-chain Data Shows Bitcoin Price Move Past $28k Resistance

As can be gleaned from the coin’s current price actions, it soared to a high of $28,432.04 over the past 24 hours. The sideways movement spurred by a volatility that has proven to be mild but dynamic has prevented the coin from maintaining the $28,000 price level as support.

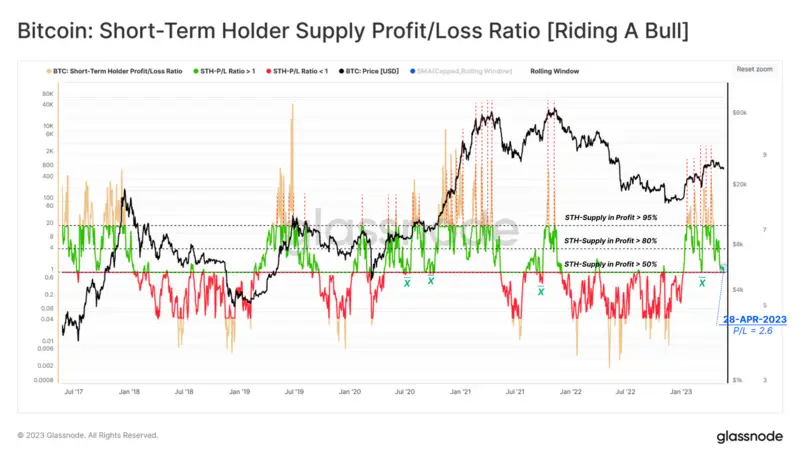

Based on the current price of Bitcoin, there are a number of important metrics to watch out for as pointed out in the Glassnode report. For one, the Short Term Holder’s unrealized profit or loss has cooled off and has returned back to a break-even level of 1.0 before bouncing back to 2.6.

Glassnode also pointed out that the proposition for a more bullish growth for the premier digital currency will be hinged on the cyclical trends in the long term supply. There is an indication that long term holders are more consistent in their buyups, even though there are seasons when they exhibit cooling periods.

Recommended Articles

With the equilibrium point generally overextended at this time, the chances that more cash injections will be introduced into the coin will be high in the mid to long term.

Bitcoin to Break Key Hurdles

Bitcoin’s potential to lead a sustained market rally is currently being swayed by several macroeconomic events in several markets around the world.

While the interest rate hikes in the United States, the UK and the European Union have remained consistent over the past few years, Bitcoin’s growth trends have been largely correlated with the mainstream stock market.

While the digital asset boasts of investors with similar strategies for the stock market, we tend to see an overlapping behavior across the market. As such, in printing an ambitious rally moving forward to retain the $28,000 price point as support, a decoupling will have to take place to enable the cryptocurrency chart a growth curve of its own.